Sales Tax

Online Risk Assessment Tool Helps Online Sellers Understand Sales Tax Obligations

Avalara launches the Sales Tax Risk Assessment at a time when businesses, primarily online sellers, are facing added sales tax complexity. The South Dakota v. Wayfair, Inc. ruling in June 2018 stated that given the power and prevalence of the ...

Apr. 13, 2020

Avalara, Inc., a provider of cloud-based tax compliance automation for businesses of all sizes, has launched a new Sales Tax Risk Assessment tool, a self-serve online resource that helps companies determine where they have likely triggered economic nexus by providing a detailed assessment of their state-by-state sales tax obligation risk over email. Avalara Sales Tax Risk Assessment enables companies to quickly discover states where their sales activity has likely triggered sales tax obligations and determine which states should be closely monitore

“As a business that sells to customers across the United States, being able to easily see each state’s economic nexus thresholds is a game-changer for us,” said Charles Bunker, CFO at Capitol Scientific. “Avalara’s sales tax assessment tool provides businesses like ours a free starting point in the journey to sales tax compliance.”

New Laws Mean New Sales Tax Obligations for Sellers

Avalara launches the Sales Tax Risk Assessment at a time when businesses, primarily online sellers, are facing added sales tax complexity. The South Dakota v. Wayfair, Inc. ruling in June 2018 stated that given the power and prevalence of the internet, states could now collect sales tax from remote sellers. To date, 44 states and the District of Columbia have adopted sales tax laws requiring businesses to use where their customers are located as part of determining compliance requirements.

Beginning in 2017, states began enforcing marketplace facilitator laws to begin collecting sales tax on third-party online marketplace sales. States can now collect sales tax attributable to third-party sales from marketplaces, rather than the individual sellers. However, in many cases, the revenue generated from marketplace sales also contributes to a remote seller crossing economic nexus thresholds. 41 states and the District of Columbia have adopted sales tax laws requiring the marketplace facilitator to collect and remit sales tax on behalf of marketplace sellers. The first step for merchants to stay tax compliant is to determine where they have economic nexus established by a certain level of economic activity in a given period, which can include analyzing sales revenue, transaction volume, or a combination of both.

How to Understand Your Sales Tax Obligations with Avalara

The free online tool provides tax professionals and online business owners with quick access to critical information to help them understand and proactively address their potential sales tax obligations, including:

● Easy data input/upload process: Businesses answer three simple questions about where they make sales and where they remit tax, or they can upload transactions with a user-friendly template.

● Economic nexus-triggering activity tracking and tax exposure: After a business inputs their sales data and provides their contact information, Avalara Sales Tax Risk Assessment will alert where their sales transactions may have triggered a tax collection obligation.

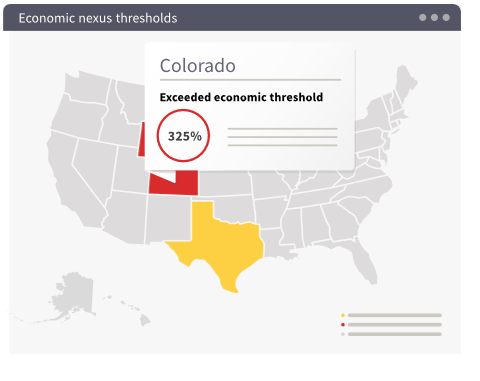

● Clear, actionable PDF reports: Users receive a PDF report that highlights where they likely have economic nexus and where they have the potential to trigger it, as well as a color-coded map to easily visualize their tax risk for more informed decision-making.

● Access to expert support: With the Avalara Sales Tax Risk Assessment, businesses can determine the next steps to become compliant and can access Avalara support with one click within the tool.

“Ecommerce businesses are struggling to manage their obligations in the ever-changing U.S. tax regulatory landscape,” said Kevin Permenter, senior analyst at IDC. “Tax assessment tools provide businesses access to the information needed to help understand their tax risk and proactively put a plan in place to address their sales tax obligations.”

“Tax rates and rules vary widely from state to state and are continuously changing, making it extremely difficult for a business to understand and keep up with where they owe sales tax,” said Paul Sanford, vice president, product management at Avalara. “The Sales Tax Risk Assessment provides an easy first step for businesses looking to get a handle on their sales tax obligations by providing them with sales tax information necessary to make more informed, proactive decisions about their business.”

For additional information and to sign up for the Sales Tax Risk Assessment tool, please click here.

Avalara helps businesses of all sizes get tax compliance right. In partnership with leading ERP, accounting, ecommerce, and other financial management system providers, Avalara delivers cloud-based compliance solutions for various transaction taxes, including sales and use, VAT, GST, excise, communications, lodging, and other indirect tax types. Headquartered in Seattle, Avalara has offices across the U.S. and around the world in Canada, the U.K., Belgium, Brazil, and India. More information at avalara.com.